The capital market is the backbone of the global financial system, where long-term debt and equity-backed securities are bought and sold. At Ecora Consulting, we specialize in providing comprehensive advisory services to corporations, governments, and investors seeking to raise capital, optimize financial structures, or make informed investment decisions.

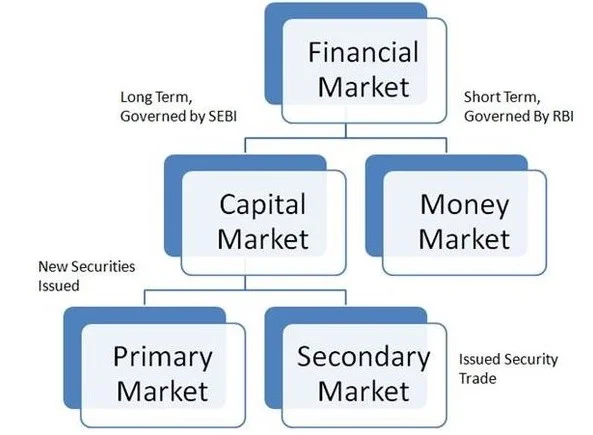

Capital markets include both primary and secondary markets, facilitating the flow of funds between investors and entities seeking capital. These markets encompass a wide range of financial instruments, including stocks, bonds, and derivatives. At Ecora Consulting, we are committed to providing clients with actionable insights and tailored solutions to succeed in the capital markets. Our deep industry expertise, global network, and commitment to client success make us a trusted partner in navigating the complexities of financial markets.

Key Features of Capital Markets:

- Liquidity: Capital markets provide liquidity to securities, allowing investors to buy and sell with relative ease.

- Price Discovery: Market forces of demand and supply help in price determination for financial securities.

- Capital Formation: Companies and governments raise funds for long-term projects through the issuance of securities.

- Risk Management: The use of derivatives and other financial instruments helps investors hedge against market volatility and risks.

Our Capital Market Services

Ecora Consulting offers a wide range of services to help businesses, governments, and investors efficiently navigate the capital markets. Our expert financial analysis and market insights empower clients to make data-driven decisions in the ever-changing financial landscape.

- Investment Banking & Capital Raising: We assist clients in raising capital through equity, debt, and hybrid financial instruments, including IPOs, bond offerings, and private placements.

- Financial Analysis & Valuation: Our financial analysis services provide deep insights into market trends, financial health, and the intrinsic value of assets. We leverage quantitative models and qualitative assessments to help clients make informed investment and financing decisions.

- Portfolio Management: Ecora Consulting offers portfolio management services for institutional and high-net-worth investors. Our portfolio strategies are designed to meet specific client objectives, whether focused on growth, income, or capital preservation.

- Fixed Income Advisory: In the fixed income space, we offer strategic advice on the issuance, trading, and management of debt securities, including government and corporate bonds.

- Equity Markets & Derivatives: Our expertise extends to equity markets, helping clients optimize equity issuance and trading strategies, and providing risk management solutions through derivatives such as options and futures.

Financial Analysis: A Data-Driven Approach

At Ecora Consulting, financial analysis is at the core of our decision-making process. By using advanced tools, financial models, and market intelligence, we help clients uncover opportunities and manage risks in the capital markets. Our approach includes:

Quantitative Analysis:We use financial ratios, statistical tools, and market metrics to provide a clear picture of market performance and risks.

Qualitative Analysis:

We combine financial metrics with qualitative factors such as industry trends, management expertise, and competitive positioning to provide a well-rounded assessment of financial health.

Market Scenario Forecasting

Our market scenario analysis evaluates potential outcomes based on different economic, geopolitical, and financial conditions. This helps clients prepare for future uncertainties by stress-testing their portfolios and capital structures.